CBN INTERVENTIONS IN KWARA AND NASARAWA STATES

In recognition that access to finance is a key limiting factor to innovation and development of the economy in Nigeria, the Central Bank of Nigerias’ key development finance interventions are targeted at priority sectors/segments which include:

- Agriculture

- Manufacturing

- Infrastructure

- HealthCare

- Youth and Entrepreneurship Development

- Export

- Micro, Small and Medium Enterprises (MSMEs)

In Kwara and Nasarawa states, the CBN has financed about 13,334 and 13,241 projects respectively. Some of these projects in the two states are highlighted below.

KWARA STATE

Kwara State is said to be the ninth largest state but the sixth least populous with an estimated population of about 3.2 million as of 2016 (NBS Data). Economically, the state is largely dependent on agriculture but have other key service industries. The Central Bank of Nigeria has financed about 13,334 projects across the state. Details of these projects include the following:

Name: Hillcrest Agro-Allied Industries Limited

Intervention: CACS

Sector: Agriculture

Location: Kwara State

Hillcrest Agro-Allied Industries Limited is a Nigerian based agro producer of premium quality parboiled rice sourced locally. The company first commenced operations in 2012, as a unit under Dayntee Farms Limited, initially just producing 54 bags of Rice which were mainly sold in Offa with the strength of 25 staff members. Having accessed funds under the Commercial Agricultural Credit Scheme (CACS) of the CBN, the company has expanded in terms of human and output capacity from 6 metric tons per hour in 2015, to operating an expanding rice mill with current production capacity of 14 metric tons per hour (75, 000 MT per annum).

The mill processes locally grown paddy into premium parboiled long grain rice using a strategy that targets building an ecosystem which integrates government’s national food security goals and community development for producers and farmers.

Tertiary Institution Poultry Revival Scheme (TIPReS)

The Central Bank of Nigeria established the Tertiary Institution Poultry Revival Scheme (TIPReS) to boost the local production and processing of poultry products by leveraging on the knowledge and experience of Nigerian tertiary institutions along the poultry value chain. It also seeks to enhance the institutions’ research & development capabilities with intent to foster local innovations. The intervention aims to build students’ and local communities’ capacities to engage with the poultry value chain in a profitable and sustainable manner.

Name: Unilorin/Ggmax Poultry Integrated Commercial Poultry Farm

Intervention: TIPReS

Sector: Agriculture

Location: Kwara State

The Unilorin/GGMAX farm is an integrated poultry farm established in February 2022 through the CBN Tertiary Institutions Poultry Revival Scheme (TIPReS). The university accessed a 600 million naira loan to build the farm which produces fresh eggs, whole broilers (live and dressed), chicken parts, poultry feeds and manures, and currently targets a production capacity of 40,000 broilers. Backward integration plans are also being implemented that include a 2,000 hectare land for Maize and Soya beans cultivation for the poultry, and the establishment of its own hatchery and an egg powder production facility.

The farm provides direct employment to 60 staff and indirect employment to about 300 individuals.

REAL SECTOR SUPPORT FACILITY-DIFFERENCIATED CASH RESERVE REQUIRMENT

The Real Sector Support Facility (RSSF) was set up with the objective of fast tracking the development of critical sectors of the economy e.g. manufacturing, agriculture value chain and the service sub-sectors of the Nigerian economy. It is aimed at increasing output, generating employment, diversifying the revenue base, increasing foreign exchange earnings and providing inputs for the industrial sector on a sustainable basis. Under this intervention programme, priority is accorded to projects with high local content, import substitution, foreign exchange earnings and potential for job creation.

Name: TASCON Plastics Industries Nigeria Limited

Intervention: RSSF/DCRR

Sector: Manufacturing

Location: Kwara State

Tascon Plastic Industries Nigeria Limited was established in 2013 for the production of PVC pipes of various sizes and thickness. Utilizing the funds accessed from the CBN intervention tailored for the real sector, the need for growth and development led the company to expand its production base from just 3 extruder pipe machines which produce at a capacity of about 3 metric tons per day to 16 extruder pipes making machines producing at a capacity of as much as 22 metric tons per day. The company has also established a new unit focused on production of PVC ceilings which currently has 6 machines and has further expanded into production of its own calcium carbonate (CaC03) used for pipe production.

OLAK ROOFING NIGERIA LIMITED

Name: OLAK Roofing Nigeria Limited

Intervention: RSSF/DCRR

Sector: Manufacturing

Location: Kwara State

OLAK ROOFING NIGERIA LIMITED is a roofing sheet producing company situated in Ilorin, Kwara State that is mainly into production of aluminium accessories, building materials, and construction. The company accessed the CBN intervention fund for the real sector to finance its new production line and has a capacity of 2500 metric tons in a month with a large number of direct and indirect employees.

NASARAWA STATE

Among the 36 states of Nigeria, Nasarawa is the fifteenth largest but the second least populous with an estimated population of about 2.5 million (NBS 2016 data). Nasarawa State has agriculture as the mainstay of its economy with the production of varieties of cash crops throughout the year. The Central Bank has financed about 13, 241 projects in the state and some of these projects are highlighted below.

COMMERCIAL AGRICULTURE CREDIT SCHEME (CACS)

As part of its developmental role, the Central Bank of Nigeria (CBN) established the Commercial Agriculture Credit Scheme (CACS) to support commercial agricultural enterprises in Nigeria. The scheme is aimed at fast-tracking development in the agricultural sector and promoting food security through affordable credit facilities to commercial agricultural enterprises in the country.

Improved funding of the Agricultural sector will Increase output and foreign exchange earnings, generate employment, diversify the revenue base, and provide input for the industrial sector on a sustainable basis. Several projects with a high impact on the economy have been funded under the scheme.

Name: OLAM Nigeria Limited Intervention: CACS

Sector: Agriculture Location: Nasarawa State

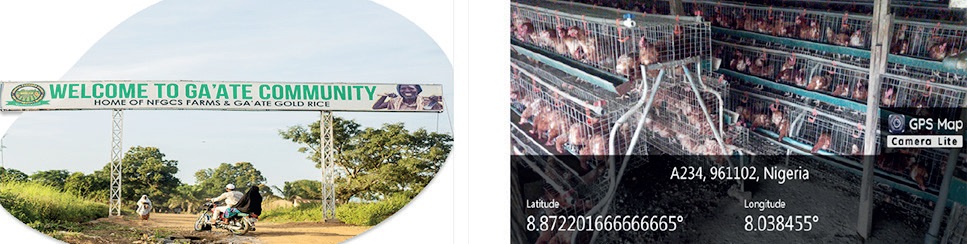

Name: Nigeria Group And Cooperative Society (NFGCS)

Intervention: CACS Sector: Agriculture Location: Nasarawa State

In 2017 a team of young Nigerians started the Nigeria Farmers Group And Cooperative Society (NFGCS). They established a farm settlement Village in Ga’ate community, Kokona LGA Nasarawa State with structures on ground to support commercial agriculture like Irrigation system, employment of Agricultural Extension Officers and purchase of sophisticated Farm Machineries.

The farm settlement village is 3,000 hectares and agricultural activities including crop production, animal husbandry, rice processing and equipment fabrication are on-going in Large scale. The group accessed funds from the Central Bank of Nigeria under the Commercial Agricultural Credit Scheme to purchase rice milling and parboiling machines with 30 tons per day and 15 tons per day capacity respectively. Part of the funds was used for the purchase of 5000 broilers and 5000 layers for poultry. 176 staff are now employed in the farm post intervention, an improvement to the 100 staff pre-intervention.

TARGETED CREDIT FACILITY (TCF)

In response to the COVID-19 pandemic, the Central Bank of Nigeria granted loans to households and small businesses to cushion the effects of the pandemic across the country. The Targeted Credit Facility (TCF) supports households and small businesses affected by the COVID-19 pandemic.

Name: Akanbi Taiwo Hassan Intervention: TCF

Sector: Agriculture Location: Nasarawa State

Akanbi Taiwo Hassan applied for the Targeted Credit Facility (TCF) despite fear of being exploited. His plan was to expand his fish farming business located at Gora, Keffi Local Government Area of the state. He is happy that the intervention has been impactful and is appreciative of the efforts of the CBN.

THE AGRI-BUSINESS SMALL AND MEDIUM ENTERPRISES INVESTMENT SCHEME (AgSMEIS)

Agribusiness Small and Medium Enterprises Investment Scheme (AgSMEIS) was established to support the Federal Government’s efforts at promoting agricultural businesses of small and medium enterprises (SMEs) as a vehicle for sustainable economic development and employment generation.

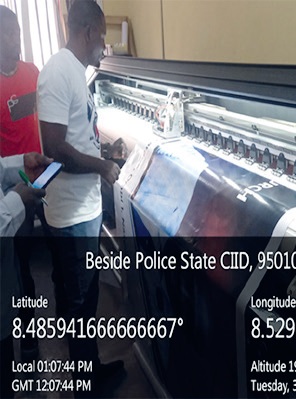

Name: Adejoh Monday Salami Intervention: AgSMEIS

Sector: SME Location: Nasarawa State

Adejoh Monday Salami heard about the Agribusiness Small and Medium Enterprise Investment Scheme, AgSMEIS and applied for a loan to purchase additional machines to expand his printing business. He accessed the loan and has grown his business including his staff strength which has increased from 3 to 7.