The Real Sector development initiatives of the Central Bank of Nigeria (CBN) were introduced to stimulate and sustain growth in key sectors of the economy, revive moribund projects, empower the youth population, explore the untapped potential in various economic landscapes and enhance foreign exchange inflow into the country.

These interventions have significantly contributed to the overall growth of the Nigerian economy, from the provision of loans at concessionary rates to cushioning the dastardly effects of the COVID-19 pandemic in the country. These initiatives which were originally designed to address the financing gap in core sectors of the economy, have now become a lifeline for most Nigerians.

About 12,688 projects in Plateau states have accessed intervention loans of the Central Bank of Nigeria. This reflects the unwavering commitment of the Bank towards poverty alleviation, job and wealth creation, and overall sustainable development of the economy. Below are some testimonials from businesses and individuals in the states who have benefitted from some of the interventions introduced by CBN.

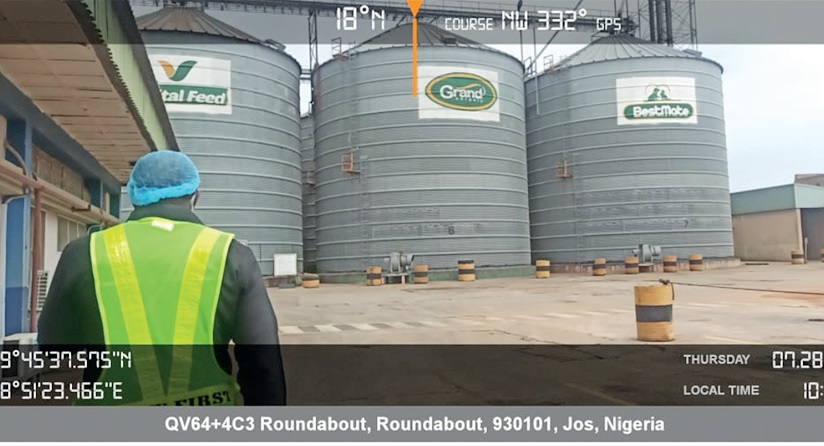

GRAND CEREALS LIMITED

Intervention: Real Sector Support Facility- Differentiated Cash Reserve Requirement (RSSF-DCRR)

Sector: Manufacturing

Grand Cereals Limited, is a strong player in the agriculture value chain. They are in the business of processing locally grown grains into a variety of breakfast cereals, edible oils, and animal feed.

The company benefitted from the Real Sector Support Facility- Differentiated Cash Reserve Requirement (RSSF-DCRR] in 2021. Accessing the loan facility afforded them the opportunity to embark on an expansion project, purchase of additional manufacturing equipment, and employment of additional skilled and unskilled labour.

The company experienced a geometric increase in its processing capacity and output, an increased production of improved soya oil, animal feed, maize flour, refined maize grits (Brabusco), and a variety of cereals consumed in the Nigerian and West African Markets.

Grand Cereals Limited is confident in its ability to contribute its quota in addressing food and animal feed needs in Nigeria and West Africa.

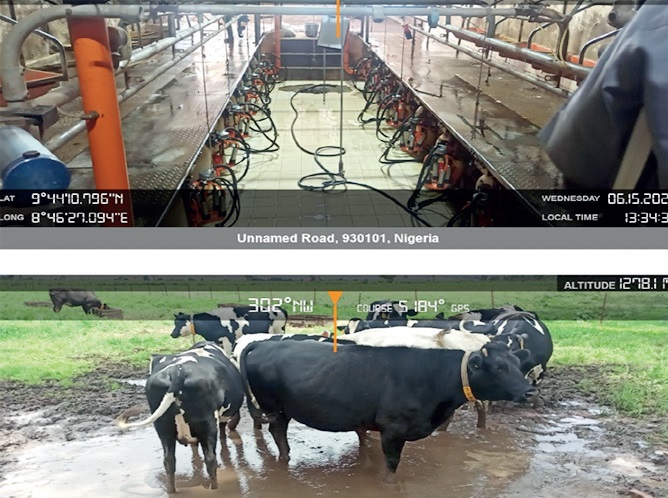

INTEGRATED DAIRIES LIMITED

Intervention: Commercial Agricultural Credit Scheme (Cacs)

Sector: Processing

Integrated Dairies Limited (IDL) stands out as one of the largest companies involved in the production and sale of dairy products in Nigeria. It currently operates on 550 hectares of land, in National Veterinary Research Institute (NVRI), Vom, Plateau State.

Integrated Dairies Limited, accessed funds through CBN’s Commercial Agricultural Credit Scheme (CACS). This led to its astronomical growth as a company: It purchased additional cattle and is presently home to more than 500 Holstein Friesian cattle (a breed of high-yielding cattle of European origin). They also acquired modern manufacturing equipment such as the REDA food processing plant and more incubation tanks for yoghurt processing.

IDL has in its employment 180 staff, operating through the entire dairy value chain- from rearing to processing and distribution of fresh dairy products which stands out as world-class products to its numerous consumers in Nigeria.

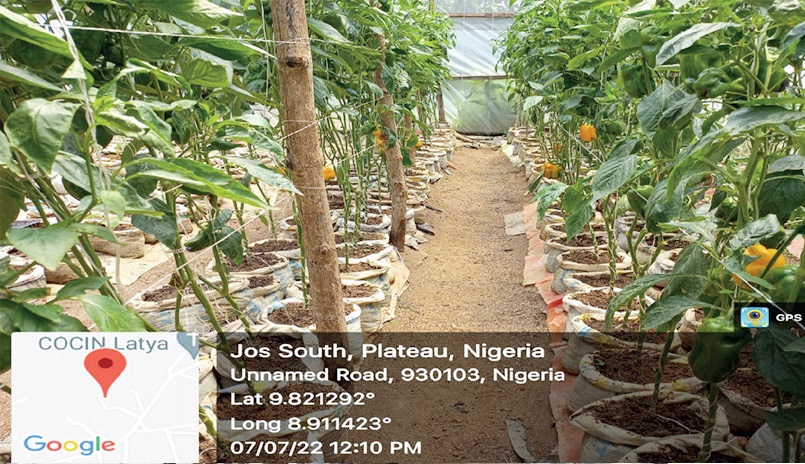

MICHAEL OLARINDE ROWLAND

Intervention: Agri-Business Small And Medium Enterprises Investment Scheme (AGSMEIS) Sector: SME

Mr. Michael O. Rowland has been passionate about farming since childhood. This deep-rooted love for agriculture stood as a constant motivation, propelling him to acquire a piece of farmland in Jos, where he cultivates a variety of pepper and tomatoes.

Through the Agri-Business Small and Medium Enterprises Investment Scheme (AGSMEIS), Mr. Rowland accessed a loan that enabled him to purchase high-yielding pepper and tomato seeds from the United States and expanded his farm from less than half-hectare to about a hectare, inclusive of a greenhouse. The loan afforded him the opportunity to purchase irrigation sprinkler equipment and employ more staff to execute his farm operations with ease.

He now boasts of increased output of his vegetables from about 18kg weekly to 45kg. He expressed his profound gratitude to the President of the Federal Republic of Nigeria and the Governor of the Central Bank for being instrumental in actualizing his childhood dreams of becoming a productive farmer.

JAMES CHETDEN

Intervention: Targeted Credit Facility (TCF)

Sector: SME

James Chetden is an entrepreneur with dreams of someday becoming a business tycoon. He currently runs a successful piggery business in Jos, Plateau State.

Mr. Chetden benefitted from the Targeted Credit Facility (TCF), another intervention of the CBN, introduced to cushion the effect of the COVID-19 pandemic on businesses. This enabled him to revive his collapsing business by purchasing more pigs, and their feed. He also hired additional hands to assist him in the business. All these have contributed to establishing and expanding the piggery.

Mr. Chetden appreciated the CBN for the opportunity and urged Nigerians to take advantage of the Apex Bank’s interventions.